Supported by lower interest rates, transaction activity held up during a year of uncertainty. This article addresses recent trends in hotel sales and capitalization rates, the course of hotel values since the last downturn, and the outlook for 2020.

Published by: Suzanne Mellen/Hotel Online

Published date: January 2020

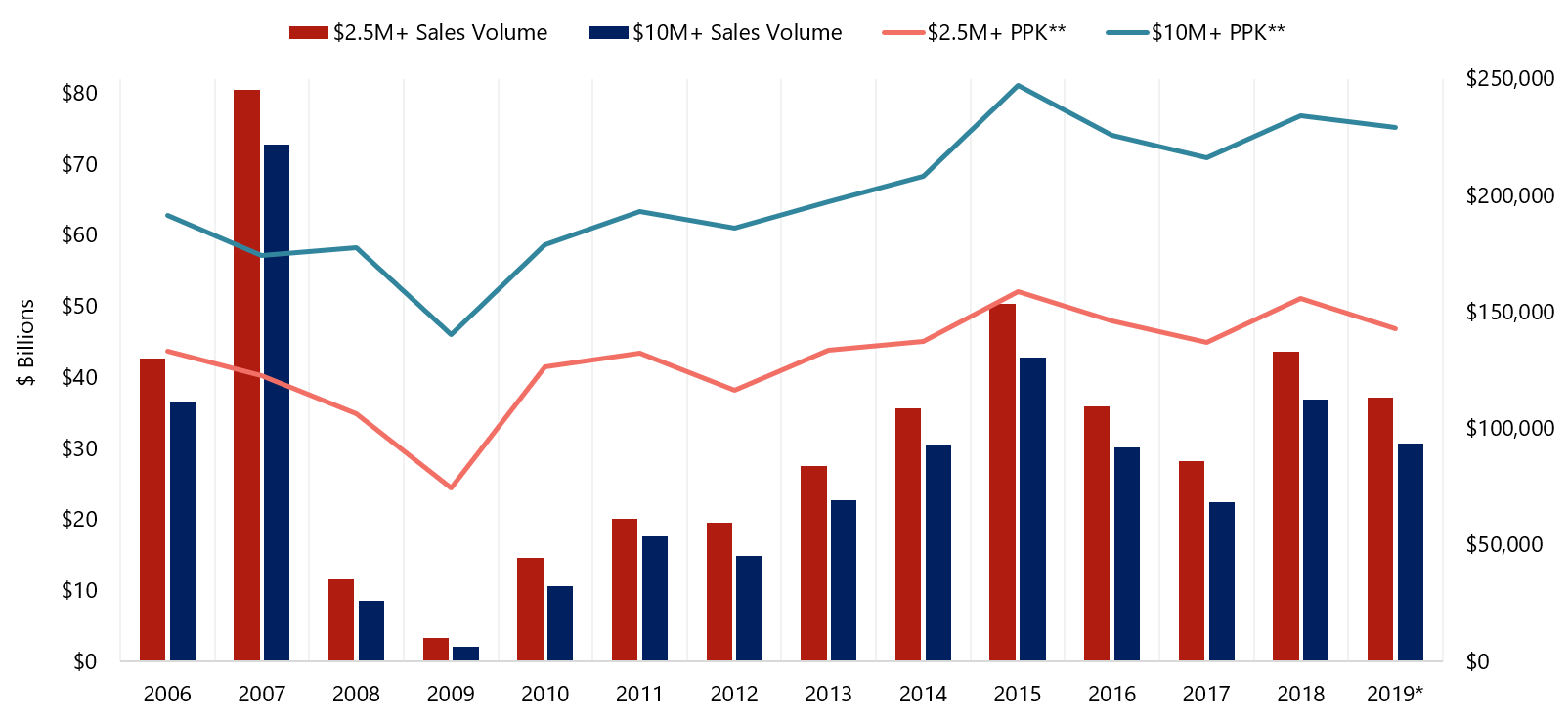

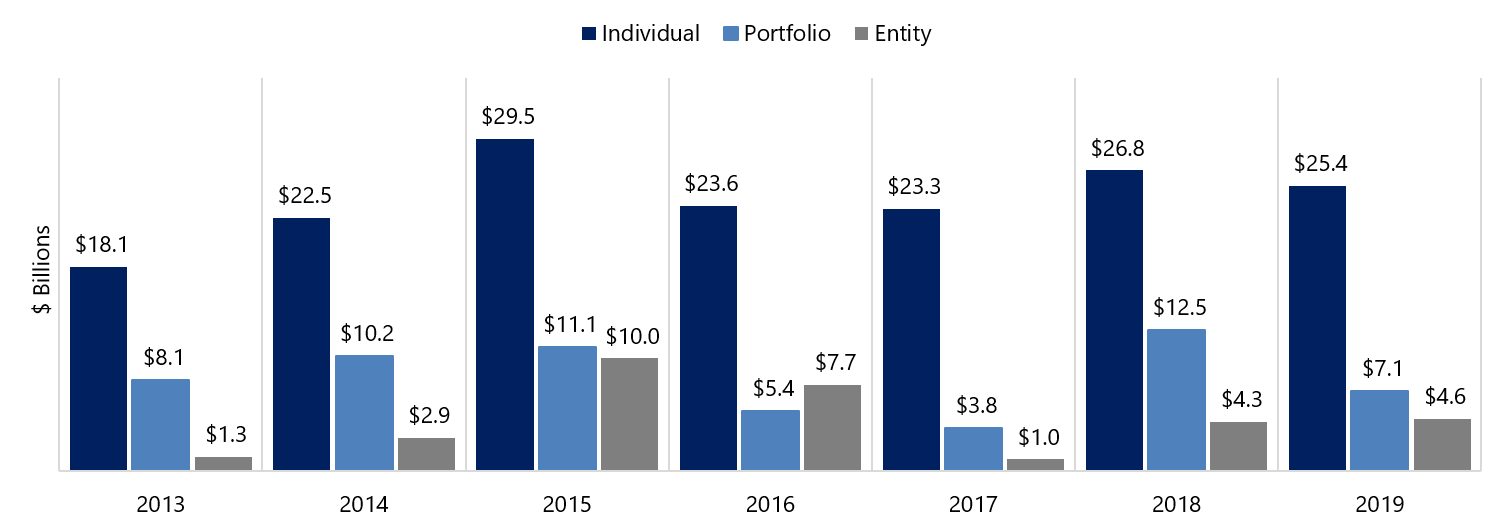

Despite increasing concerns about a global economic slowdown, the trade war, and geopolitical risks, the U.S. hotel transaction market remained healthy and active in 2019. According to preliminary data generated by Real Capital Analytics (RCA), total sales volume declined by 15%, from $43.6 billion in 2018 to $37.1 billion in 2019, though as will be illustrated, the decline was due primarily to lower portfolio sales activity.[1] Hotel owners took the pause in asset appreciation to winnow their portfolios, while buyers looking for higher yields pursued value-add opportunities. The lodging sector continued to attract interest from new investors looking for higher returns than those offered by other real estate sectors, and the availability of low-cost debt supported continued transaction activity.

The average price per key for all sales (price of $2.5 million and over) decreased by 8%, from $155,000 in 2018 to $142,000 in 2019, reflecting a smaller number of high-price per key deals. Total volume for hotels that sold for $10 million and over (major hotel sales) decreased by 17%, while the number of major hotels sold decreased by 11%, from 778 to 688, reflecting that sales of large, higher-priced deals slowed significantly. The major sales average price per key decreased by 2%, from $234,000 to $229,000. Sales volume for hotels that sold at a price of $2.5 million to $10 million remained steady at $6.8 billion, and the number of hotels sold and average price per key remained stable as well, at approximately 1,300 hotels and $57,000 per key, respectively. These metrics reflect the stronger activity sustained by the low end of the market. Owner-operators of smaller assets are typically less affected by global market concerns than investors of highly priced assets; these smaller deals are also easier to finance.

Source: RCA

Source: RCA