This article was first published in the April Edition of World Waterpark Magazine

For the ever-growing waterpark industry, 2019 will be another year for robust growth as over $1 billion in investment is slated for indoor and outdoor waterparks and their related resorts. We project 21 municipal and private outdoor waterparks will open and three resorts will add or expand outdoor waterparks. The indoor segment will total 629,200 square feet of new waterpark space in 12 properties.

Three of this year’s most anticipated and expensive new waterparks are all indoor facilities. They include the 225,000-square-foot DreamWorks Waterpark at American Dream Mall in Rutherford, New Jersey; the 350-room Great Wolf Lodge with an 85,000-square-foot indoor waterpark in Scottsdale, Arizona; and the 324-room Kartrite Resort with an 80,000-square-foot indoor waterpark in Monticello, New York.

2019 WATERPARK STANDINGS FOR U.S. AND CANADA

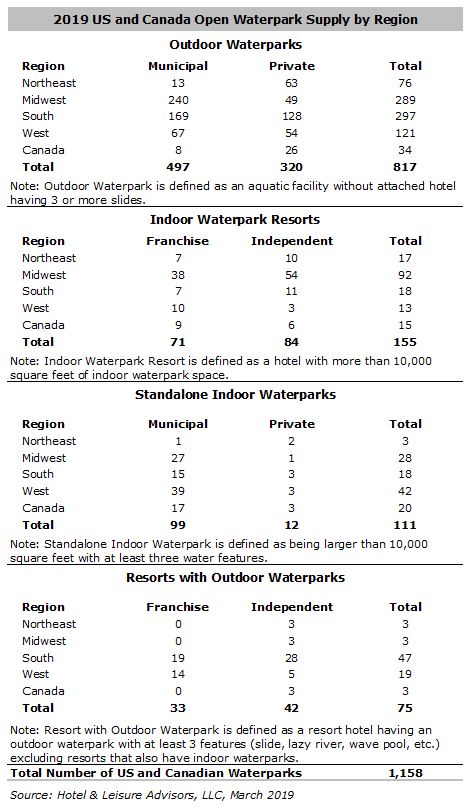

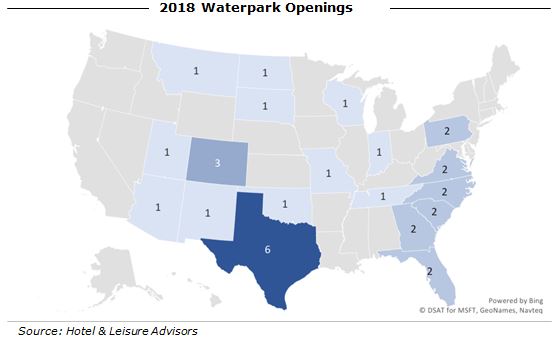

As of March 2019, the United States and Canada had a total of 1,158 waterparks. Thirty-three waterparks opened in 2018. Most of these openings were in the standalone outdoor segment, with three new private facilities and 16 new municipal facilities. Eleven openings contributed to the indoor supply, and three resorts opened new outdoor waterparks. Changes in our counts are driven not just by openings, but also by closings, expansions, and discovery of established parks not previously identified.

The following table identifies, by region, the current supply of waterparks.

Standalone outdoor waterparks are the most popular waterpark segment in the U.S. The following bullets breakdown the numbers regionally:

- Midwest and South are home to the most waterparks, with 412 and 380, respectively.

- The South maintains its lead over the Midwest in total number of outdoor waterparks (297 versus 289), while Canada has the fewest at 34.

- Outdoor waterparks in the South typically have slightly longer operating seasons than those in the Northeast and Midwest due to more favorable weather conditions.

- The Midwest leads the U.S and Canada in indoor waterpark resorts by a large margin with 92.

- The West leads in standalone indoor waterparks with 42, primarily due to the large number of municipal indoor aquatic facilities with waterparks in Colorado and Utah.

- The South leads in resorts with outdoor waterparks with 47.

- Indoor waterparks account for a greater proportion of the Canadian market with 34 indoor resort and standalone facilities. Outdoor waterparks hold only a slight majority at 37.

2018 NEW OPENINGS YEAR IN REVIEW

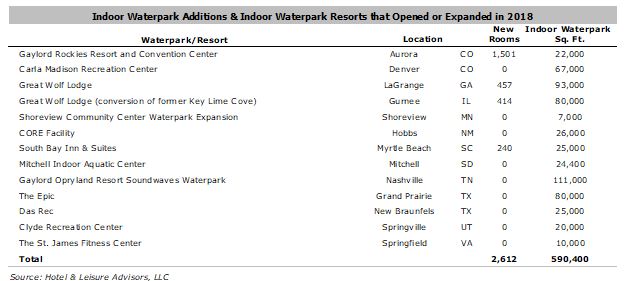

Indoor Waterpark Openings: In 2018, 13 indoor waterpark additions or expansions added 590,400 square feet of indoor waterpark space and 2,612 guestrooms. This represents the largest increase in square footage since 2008 and the largest room addition since 2009. New indoor waterpark square feet at these openings ranged from 10,000 to 111,000, showing the wide range that exists in the breadth and scope for various projects in 2018.

The Gaylord Opryland Resort in Nashville, Tennessee, opened the largest new indoor waterpark with its 111,000-square-foot Soundwaves Waterpark. The new Great Wolf Lodge in LaGrange, Georgia, contributed 93,000 square feet. The increase in resort rooms is largely attributed to the Gaylord Rockies Resort and Convention Center with 1,501 rooms. The Epic in Grand Prairie, Texas, is the largest municipal indoor waterpark to open in 2018.

Outdoor Waterpark Openings: Nineteen new standalone outdoor waterparks opened in 2018. Though all meet H&LA’s definition of having at least three waterslides, these facilities range substantially in size and scope.

Keeping with the overwhelming trend, most of the 2018 openings were municipal facilities, and more than half were in the South where this is a more favorable operating season due to better weather conditions.

- The Otter Co-op Outdoor Experience in Langley, British Columbia, is the sole Canadian property to open.

- Cactus Springs Waterpark at Funtasticks Family Fun Park in Tucson, Arizona; Rigby’s Water World in Warner Robins, Georgia; and Maui Jack’s in Chincoteague Island, Virginia are the three new privately-owned standalone outdoor waterparks to open in 2018.

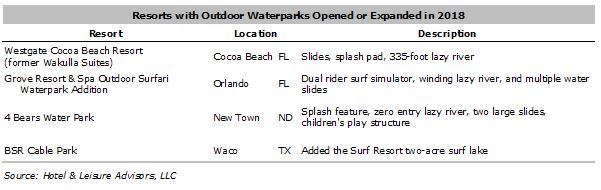

Resorts with Outdoor Waterparks Openings: Four hotels and resorts debuted outdoor waterparks.

Resorts with outdoor waterparks represent the smallest expanded segment, which is a trend likely to continue in 2019 and beyond.

PROJECTIONS FOR 2019

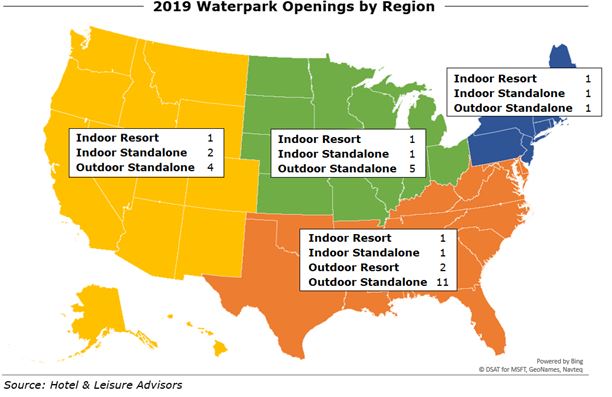

For 2019, we will see growth across all segments of the waterpark market with openings of 33 facilities. We also anticipate expansions of almost 20 existing facilities. Regionally, the South leads the U.S with 15 projected openings, with the majority of these in Florida or Texas. The West and Midwest each expect seven openings, while the Northeast will see three and Canada (not mapped) will have one.

Though 2019 will see a greater increase in total resort waterpark area, fewer new resort rooms are planned. Fourteen standalone indoor waterparks and indoor waterpark resort expansions or new builds will contribute 609,200 square feet of waterpark space and nearly 1,000 new rooms. The largest is the 225,000-square-foot DreamWorks Waterpark at American Dream Mall in Rutherford, New Jersey.

Greater increases are projected in outdoor waterparks (including resorts with outdoor waterparks), which comprise 77% of the U.S. and Canadian supply. This year, 24 outdoor waterparks will be added to the supply. While most of these are municipally-owned facilities, the largest new parks are private ventures.

The Grand Texas Sports and Entertainment District in New Caney, Texas will debut its Big Rivers Waterpark this year, after delays from their planned 2018 opening. Following a renovation and rebranding, the JW Marriott Miami Turnberry Resort and Spa plans to open its Tidal Cove Waterpark in spring 2019. The new Margaritaville Resort Orlando in Kissimmee, Florida, is now welcoming guests and anticipates the opening of its H2O Live! Waterpark later in 2019. These privately-owned waterparks feature more extensive amenities, including wave pools, multi-slide towers, and surf simulators.

Challenged Waterparks

The waterpark industry had its share of challenged properties in 2018 including:

- The CoCo Key Waterpark Resort in Omaha, Nebraska, is burdened by $1.6 million in unpaid property taxes and contractor’s bills and is for sale.

- The Breakers Waterpark in Marana, Arizona, and Waterslide World in Lake George, New York, closed in 2018.

- The Schlitterbahn Waterpark in Kansas City, Kansas, struggled as a Wyandotte County, Kansas Grand Jury indicted Schlitterbahn and three employees/owners with multiple charges of negligence related to the death of a visitor riding the Verruckt slide, which was subsequently decommissioned and torn down. On February 22, 2019, a Kansas judge dismissed charges in the criminal case against the three employees/owners; however, the company has not committed to opening for the 2019 season.

Conclusion

Waterpark development continues in select markets in the United States and Canada with development costs for both indoor and outdoor waterparks increasing as developers try to enhance the quality and attraction mix of their facilities. The new DreamWorks indoor waterpark at the Meadowlands in New Jersey will raise the bar on new waterpark developments as it will be the first major indoor waterpark to have a movie company partnership and theming. It will also become the largest indoor waterpark in the United States. Pricing for well-designed waterparks in prime locations is increasing; although for existing parks, it is growing at closer to inflationary levels.

Numerous outdoor waterpark facilities are being added at both municipal facilities and private venues. These typically seasonal facilities provide added summertime recreation for guests and enhance a municipality’s recreational offerings. The suppliers of waterparks continue to expand their attraction mix offerings in what is increasingly a global mix of companies.

The year ahead will continue with modest growth seen previously but will also bring more innovation and progress for the industry. Waterparks continue to grow and evolve, making it an exciting time for the industry. As always, H&LA continues to stay abreast of all the new additions and changes happening in this dynamic industry.